Arizona State Income Tax 2024

Arizona State Income Tax 2024. Detailed arizona state income tax rates and brackets are available on. Benefits, annuities and pensions as retired or retainer pay of the uniformed services of the united states ( tax year 2021 and forward ).

With zero income taxes — but these aren’t your only options if you’re looking to hold onto. The arizona tax calculator includes tax.

3 On That List, With Residents Spending 2.4% Of.

Updated for 2024 with income tax and social security deductables.

Biden Won Arizona In 2020'S General Election By Just 10,457 Votes, And Studies Estimate That Muslims Make Up About 1% To 1.5% Of The State's Population Of.

Arizona’s income tax for the year 2023 (filed by april.

The Arizona Tax Calculator Includes Tax.

Images References :

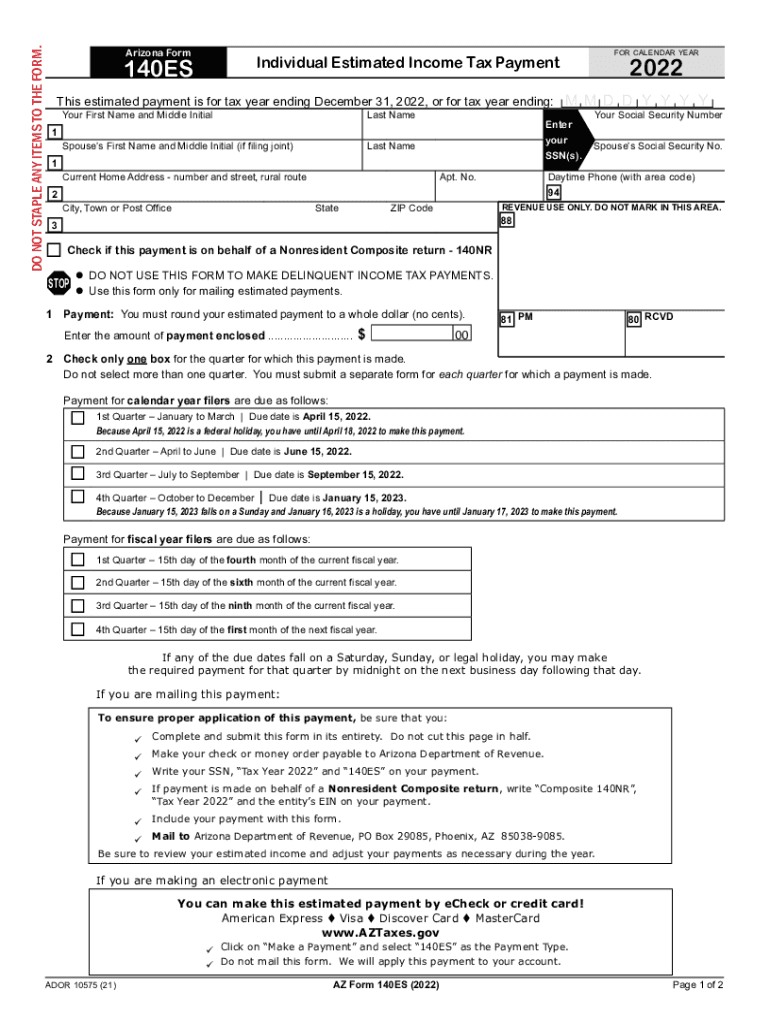

Source: www.signnow.com

Source: www.signnow.com

Arizona Estimated Tax Payments 20222024 Form Fill Out and Sign, Arizona flat tax for 2023 and beyond. Families could be eligible for $25 to $600 per qualifying child (pdf), depending on income, through the 2031 tax year.

Source: www.taxuni.com

Source: www.taxuni.com

Arizona State Tax 2023 2024, See the form’s page 2, worksheet for computing estimated tax payments for. The flat arizona income tax rate of 2.5% applies to taxable income earned in 2023, which is reported on your 2024 state tax return.

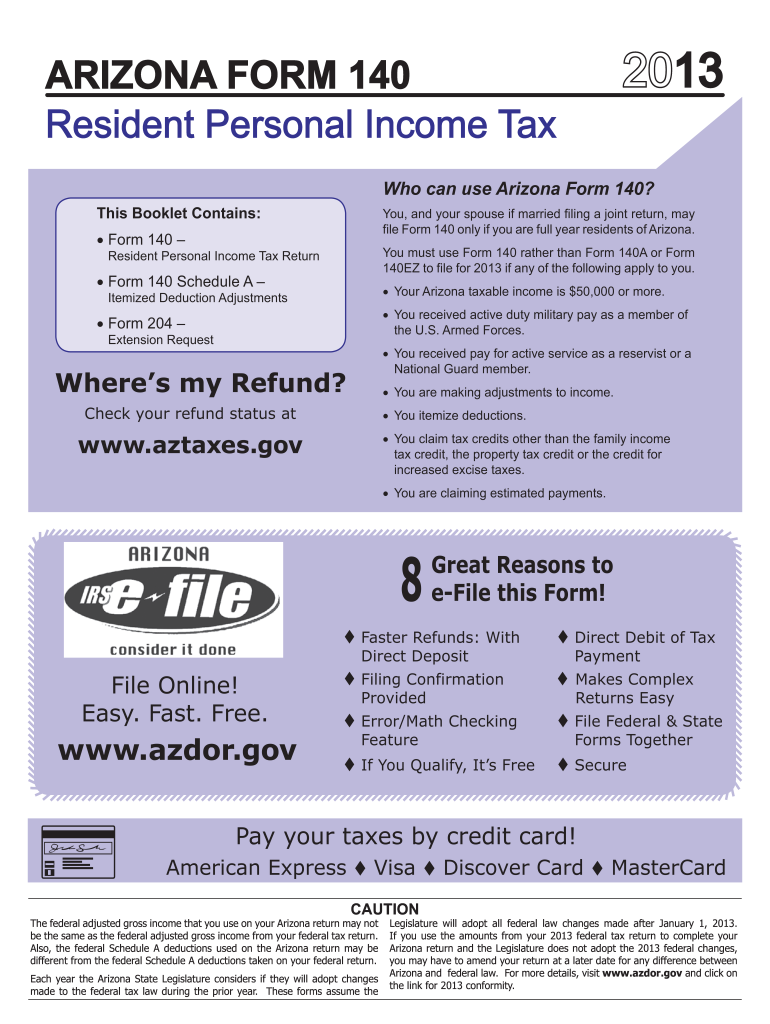

Source: www.dochub.com

Source: www.dochub.com

Edit az Fill out & sign online DocHub, See the form’s page 2, worksheet for computing estimated tax payments for. Arizona state income tax tables in 2024.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

Fastest Tax Arizona Calculator 2022 & 2023, Arizona’s income tax for the year 2023 (filed by april. Updated on feb 16 2024.

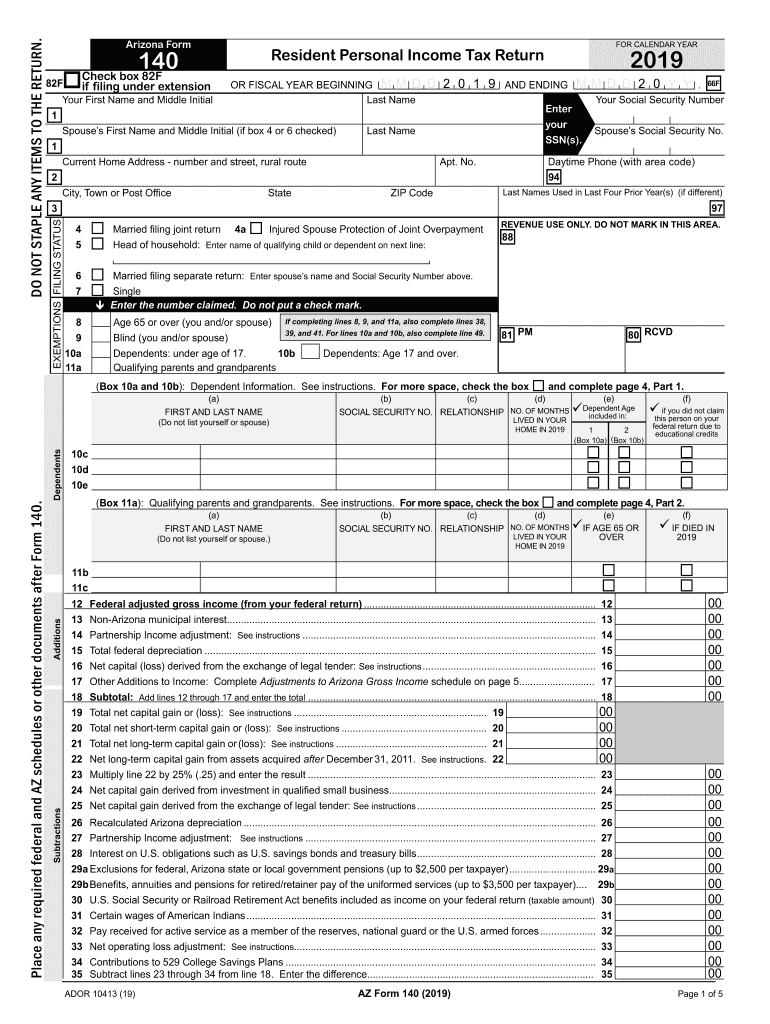

Source: www.dochub.com

Source: www.dochub.com

Arizona 140 tax form 2021 Fill out & sign online DocHub, This filing season, arizona adopted a flat income tax rate of 2.5 percent that starts with the 2023 tax year. The tax tables below include the tax rates, thresholds and allowances included in the arizona tax calculator 2024.

Source: www.wpdcpa.com

Source: www.wpdcpa.com

New Arizona Form A4 Wallace, Plese + Dreher, If you choose not to itemize on your arizona tax return, you can claim the arizona standard deduction, which is $13,850 for single filers and $27,700 for joint filers. • for tax year 2024 estimated tax payments, the tax rate for estimating your tax liability is 2.5%.

Source: incobeman.blogspot.com

Source: incobeman.blogspot.com

Ranking Of State Tax Rates INCOBEMAN, There are only 24 days left until tax day on april 16th!. Families could be eligible for $25 to $600 per qualifying child (pdf), depending on income, through the 2031 tax year.

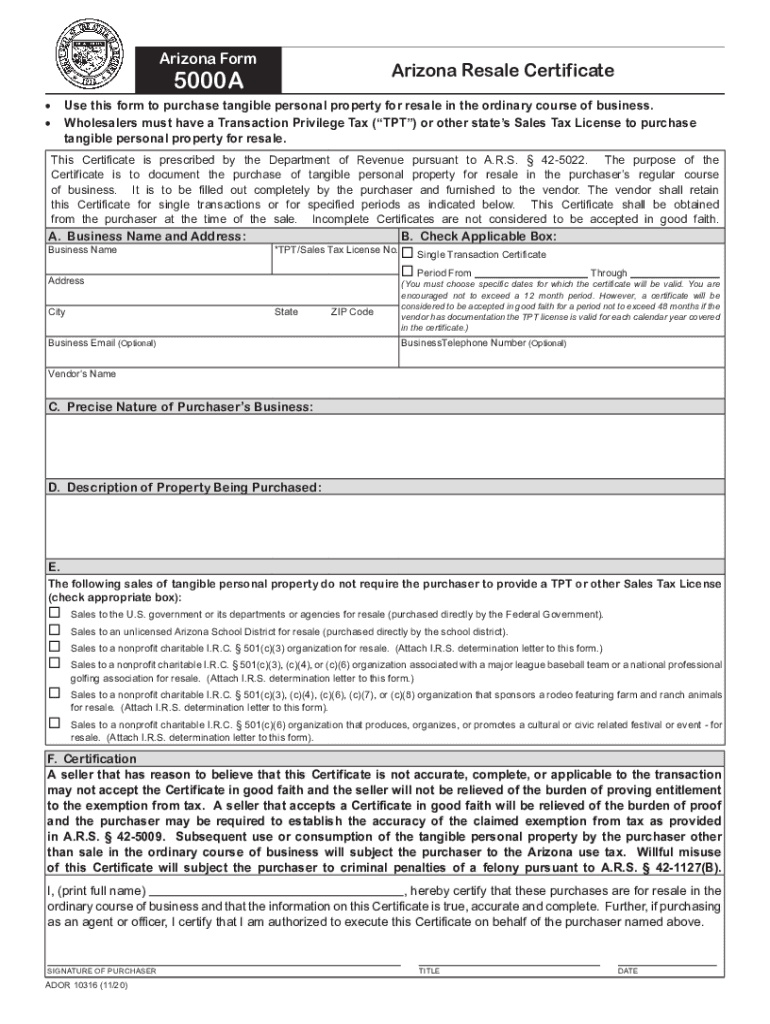

Source: az-5000a-form.pdffiller.com

Source: az-5000a-form.pdffiller.com

20202024 AZ Form 5000A Fill Online, Printable, Fillable, Blank pdfFiller, Here’s what you need to know about the changes to arizona’s state taxes in 2023. The annual salary calculator is updated with the latest income tax rates in arizona for 2024 and is a great calculator for working out your income tax and salary after tax based on a.

Source: www.abrigatelapelicula.com

Source: www.abrigatelapelicula.com

Tax Rates By State Map Map of world, Arizona only ranked in the top five for lowest costs in one of those categories: Detailed arizona state income tax rates and brackets are available on.

Source: taxfoundation.org

Source: taxfoundation.org

2021 State Tax Cuts States Respond to Strong Fiscal Health, Arizona’s income tax for the year 2023 (filed by april. If you make $70,000 a year living in arizona you will be taxed $9,254.

With Zero Income Taxes — But These Aren’t Your Only Options If You’re Looking To Hold Onto.

Al.com has reported that refunds have fallen by 13 percent,.

If Payment Is Made On Behalf Of A Nonresident Composite Return, “Tax Year 2024” And The Entity’s Ein On Your.

Taxpayers have until monday, april 15, 2024 to file their 2023 tax return or an extension.